Money Explained • 2011 • 5 episodes •

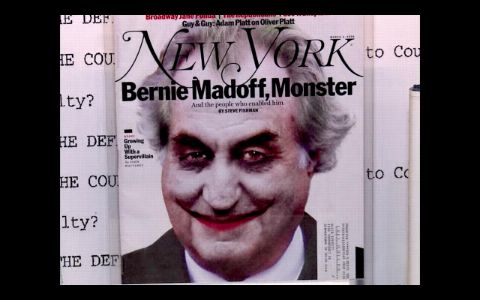

Why do people keep falling for financial scams? Dive into the history of con artists and how technology makes it easier for these schemes to flourish.

2011 • Economics

The convenience of credit cards comes at a price. From the methods banks use to maximize profits to a debt myth debunked, take a look inside the system.

2011 • Economics

Higher education helps society. But paying for it can be ruinous. What led to the U.S. student debt crisis, and is there a way to fix it?

2011 • Economics

Retiring comfortably middle-class in America requires more than $1 million in savings. How did the dream of golden years leisure get so out of reach?

2011 • Economics