Part 1 • 2014 • episode "S1E1" • The Men Who Made Us Spend

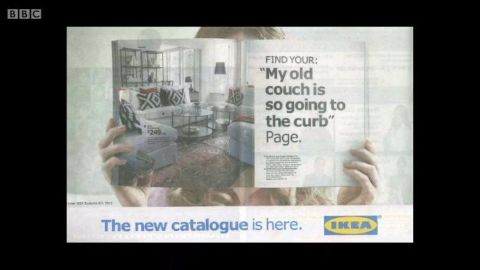

In the first of this three-part series investigating consumer spending, Jacques reveals how the concept of 'product lifespan' holds the key to our ever-churning consumerism. Exploring the historical origin of planned obsolescence, when some of the world biggest electrical manufacturers formed a light bulb cartel in the 1920s, Jacques reveals how products that are essential to our modern lifestyles are still made to break. During his investigation, Jacques uncovers the process by which a crucial transformation happened and attitudes towards spending were transformed. Instead of needing new goods because our old ones were broken, we learned to want them for reasons of fashion and aspiration - awaking a consumer appetite that could never be satisfied. In the US, he visits a recycling centre where brand-new high-tech goods are destroyed before they have even come out of the box. Jacques also meets some of the companies that encourage consumers to be dissatisfied with what they have and encourage purchases as part of an ever-faster cycle of 'upgrades'. He asks a senior IKEA executive why, despite the company's commitment to sustainability, it still encourages repeated discarding and purchasing. Jacques also talks to a former senior Apple employee who reveals how the company's new focus on fashion, with its colourful iPhones, keeps us buying even when technological innovation slows.

Make a donation

Buy a brother a hot coffee? Or a cold beer?

Hope you're finding these documentaries fascinating and eye-opening. It's just me, working hard behind the scenes to bring you this enriching content.

Running and maintaining a website like this takes time and resources. That's why I'm reaching out to you. If you appreciate what I do and would like to support my efforts, would you consider "buying me a coffee"?

Donation addresses

BTC: bc1q8ldskxh4x9qnddhcrgcun8rtvddeldm2a07r2v

ETH: 0x5CCAAA1afc5c5D814129d99277dDb5A979672116

With your donation through , you can show your appreciation and help me keep this project going. Every contribution, no matter how small, makes a significant impact. It goes directly towards covering server costs.